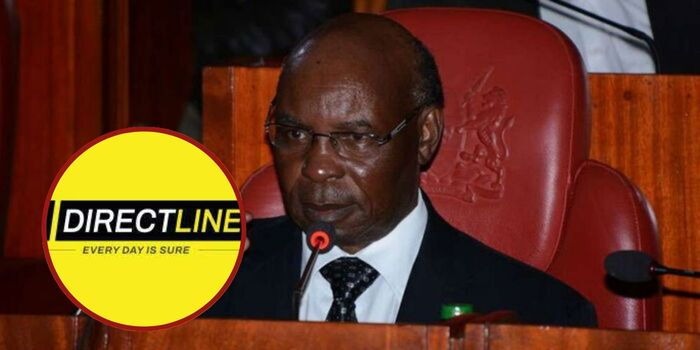

In a shocking turn of events, Directline Assurance Company, which reportedly controls over 60% of the Kenyan Public Service Vehicles (PSVs) insurance market, has abruptly ceased operations. This unexpected closure has sent shockwaves through the industry, raising serious concerns about market stability.

In a brief yet explosive statement, Dr. SK Macharia, Chairperson of Royal Credit Limited, the parent company of Directline, announced not only the termination of all Directline employees but also the immediate dissolution of the company’s Board of Directors. Royal Credit Limited is set to take over all assets previously owned by Directline, signaling a dramatic shift in the company’s future.

Macharia revealed that the closure was triggered by the Insurance Regulatory Authority (IRA) freezing Directline’s bank accounts. This drastic move has crippled the company’s financial operations, making it impossible to continue its services. Furthermore, Macharia blasted the IRA for failing to act against the company’s former directors, whom he accused of mismanaging a staggering Ksh7 billion.

In the wake of this controversial decision, Directline announced the immediate suspension of all insurance services, leaving countless policyholders in limbo and the industry reeling from the fallout.

Stay tuned for further updates on this developing story as the implications of Directline’s closure and the alleged financial misconduct continue to unfold.

Discover more from ULIZA LINKS NEWS

Subscribe to get the latest posts sent to your email.