Kenya’s government will use $1 billion from a debt-for-food security swap to reduce the country’s heavy debt. President William Ruto said the United States Development Finance Corporation (US-DFC) will support the deal. The plan allows Kenya to replace expensive Eurobonds with cheaper financing. Savings will go toward food security projects.

The Public Debt Management Office (PDMO) said the swap funds will pay off costly Eurobonds maturing in 2031. The swap works like debt-for-nature deals, exchanging expensive loans for cheaper funding tied to social or environmental projects. Raphael Owino, PDMO Director-General, said the deal will conclude by the end of the financial year. The new financial instrument will allow Kenya to retire high-interest debt efficiently.

Kenya currently has KSh 872.2 billion in Eurobonds. Two bonds maturing in 2027 and 2028 total KSh 72.4 billion. Interest payments this year are projected at KSh 84.73 billion, up from KSh 73.89 billion last year. The swap will cut repayment costs and reduce pressure on taxpayers.

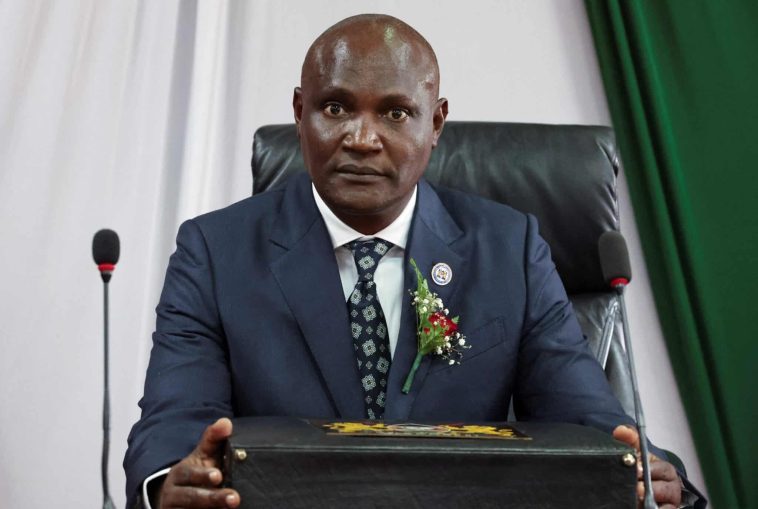

President Ruto said the deal allows interest savings to support food security programs. It will strengthen resilience and help vulnerable communities. “We appreciate DFC for agreeing to the $1 billion debt-for-food security swap. It lets us replace costly debt with cheaper financing,” he said on X.

The swap highlights Kenya’s strategic debt management while supporting social programs. Meanwhile, the government will engage the IMF on a new loan program. Officials are expected in Nairobi in February 2026. Kenya’s total public debt was KSh 12.25 trillion as of November 2025.

By reducing repayment costs and directing savings to essential programs, Kenya aims to improve fiscal stability and social welfare. The plan combines financial prudence with national development goals.

Discover more from ULIZA LINKS NEWS

Subscribe to get the latest posts sent to your email.